One of the big strengths of Sage X3 is its ability to cater for multi-company scenarios.

Irrespective of the size of your group, one issue with having multiple systems (or even multiple instances of the same system) across multiple companies is the level of control that you have over account coding and then the ensuing reporting. Adding a new code to your trial balance in one company can cause inconsistencies across the group if that code isn't replicated elsewhere, leading to, at best, manual workarounds to ensure that everything is reported correctly and, at worst, potentially incorrect consolidation leading to financial decisions based on an “apples being added to pears” scenario.

With Sage X3, you maintain your Charts of Accounts centrally as master data, so that changes in any chart are immediately updated across the various accounting models (and therefore companies) using that chart. That means that you can share a single set of accounts across multiple companies, safe in the knowledge that any new accounts will be automatically reflected across the group. A centralised approach to GL account maintenance is advisable in this situation, to ensure that consistency is being maintained.

If different companies are using different charts of accounts, however, then there are still a number of ways to aggregate relevant totals to provide meaningful results, including:

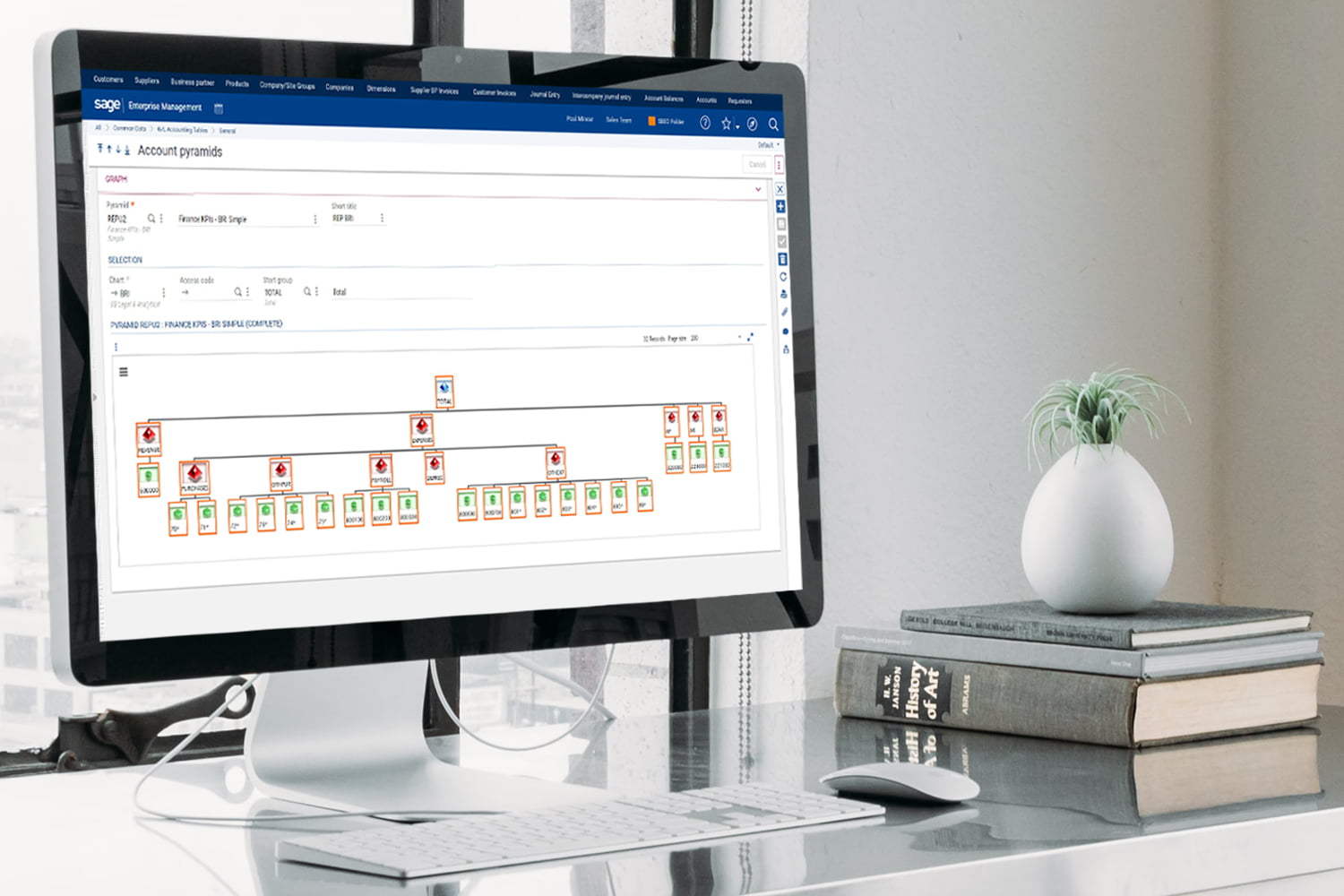

- Account Pyramids: Accounts are categorised into a tree-like structure, with multiple levels of sub-totalling, e.g. multiple revenue streams being grouped together by revenue type and then into an overall “Revenue” number and then ultimately Gross Profit. Within each “branch” of the structure, you decide which GL accounts are to be included. If later on you decide that, a particular revenue stream should actually be offset against an expenditure total, then you can simply move the appropriate GL account from one pyramid branch to another.

Account Pyramids: Using Account Pyramids you can create a multi-level reporting structure to suit your requirements, click on image to enlarge

- Reporting Codes: Similar to Account Pyramids, although the categorisation is performed on the GL account record itself. An account can have multiple Reporting Codes for different purposes and can also be reported differently depending on whether the account is in debit or credit balance.

- Multiple Ledgers: This allows you to define each accounting model as effectively consisting of multiple charts of accounts, with mappings between the source “legal” chart for each company and a common chart for the group; so if you have 3 companies, for example, each with separate charts, they can all point their accounts to the common group structure. With this type of set up, the group trial balance is updated using the mappings in real time. This means that the Group Accountant can look at the group position at any point throughout the month, using standard financial enquiries and reports, without having to wait for month end.

Multi-Territory Benefits

The concept of a multi-ledger instance becomes even more powerful when we consider a group of companies located across different territories. In certain countries, such as France and Germany, local legal reporting requires a standardised chart of accounts, meaning that group level reporting usually then requires some form of mapping exercise. Tax rules and rates also differ from country to country, so being able to assign an appropriate Legislation code to the company will also impact how the legal ledger is used and coded. A number of countries have complex purchase and sales tax structures and so the number of tax accounts in the different legal ledgers may vary enormously – hence the need to then think carefully about mappings into a group structure.

Mappings: In a multi-ledger set up you can map accounts in one chart of accounts to accounts in others, so that postings flow through automatically

Finally, if legal reporting is required in local currency then the system of choice must be able to easily translate activity into the group reporting currency. Using Sage X3 each company can transact in its own local currency and then maintain and update multiple exchange rates, so that your reporting ledger is always using a consistent conversion rate for budget comparisons, for instance. For example, you can transact in GBP, with an automatic conversion into USD at a group exchange rate into the group reporting structure in real time.

Financial Reporting

When it comes to intercompany activity, Sage X3 allows you to automatically post cross-charges between companies, as well as offering a number of options for including or excluding intercompany postings. These mainly revolve around the ability to filter transactions in or out based either on how they were generated or on various attributes attached to postings – these include: dimension values, document types or even special company codes set up to identify cross-charges before they are posted into the receiving company's books.

A financial reporting structure using Sage X3 may incorporate elements of all of the different options above, depending on the complexity of group reporting requirements. The best fit solution will be robust and repeatable, while at the same time being adaptable to changing circumstances, enabling you to keep control over group finances. While we're not necessarily advocating throwing your Excel models away, Mysoft's team of consultants have the experience to help you design strong solutions using standard functionality within Sage X3, providing real time information, to enhance, streamline or simply complement your existing reporting solutions.

Find out more:

- See the benefits of analytical dimensions in Sage X3

- Discover how to improve your purchasing process

- Get a free quote for implementing Sage X3